Start Right and Grow Fast

Detailed Fund Management Technology for Modern Private Lenders

Experience a private mortgage fund platform rooted in transparency and reliability. Streamline fund organization, investor relations, and performance reporting with tools designed for secure and efficient operations.

Book A Demo

Optimize Private Fund Structures for Growth

Versatile Fund Settings and Options

Customize fund structures with ease, offering fixed or floating share prices and adaptable interest rate options. Adjust fund settings to align with market conditions and investor preferences, easily connecting the fund to the mortgage. Simplify revenue tracking with pre- or post-DRIP NAV calculations and choose between cash or accrual-based recognition for precise and compliant financial reporting.

All-In-One Fund Dashboard

Simplify Investor Management with Confidence

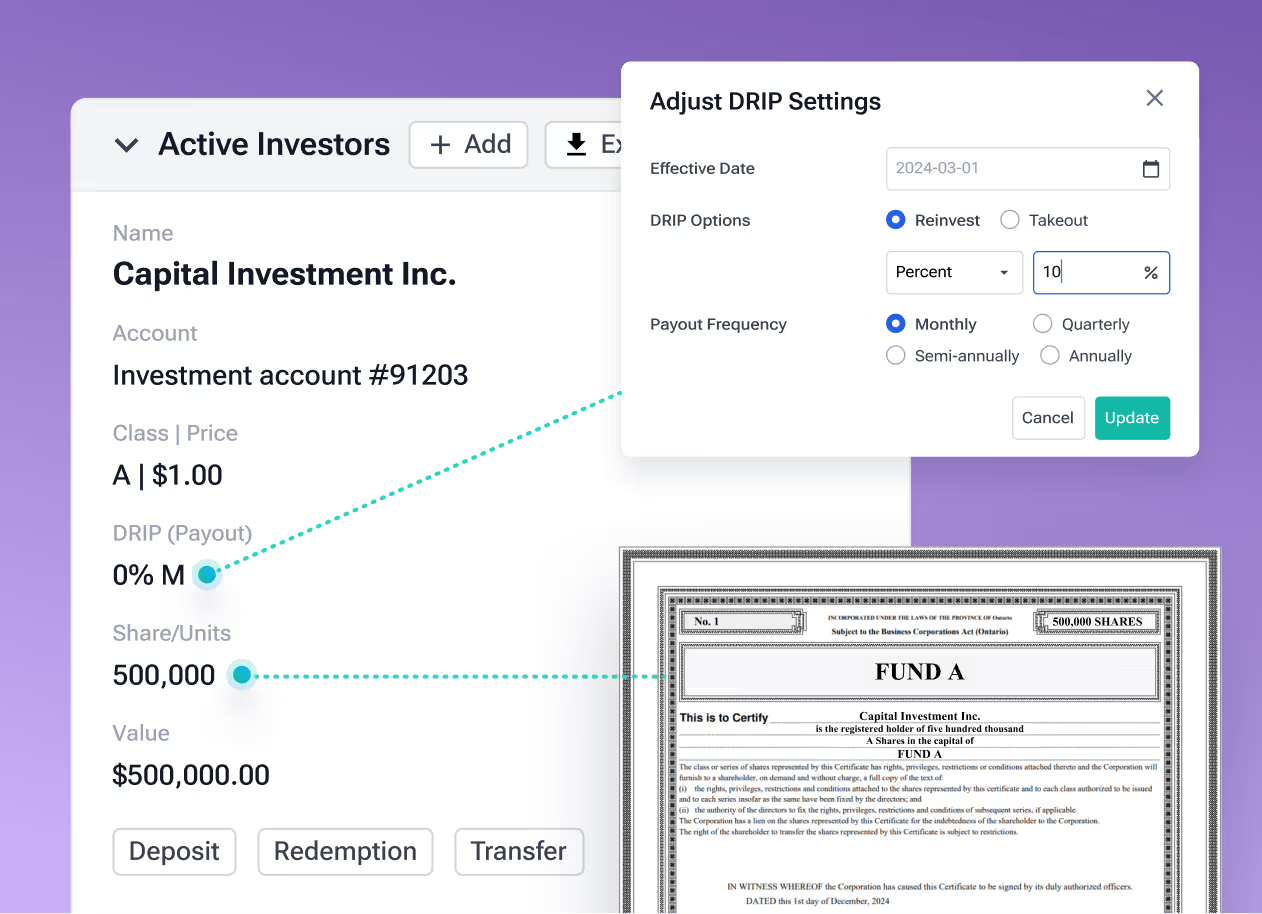

Effortless Investor Relations

Automate subscription agreements, share certificates, direct payments, and trade confirmations seamlessly. Offer diverse investment options and flexible DRIP plans with customizable payout schedules monthly, quarterly, semiannually, or annually.

Clear Communication

Flexible Transaction Processing

Effortlessly manage deposits, redemptions, and transfers across share classes or investment accounts, with built-in support for accrued interest calculations. Streamline fund movements while maintaining accuracy and compliance, ensuring seamless transactions for investors and administrators alike.

Generate Concise and Actionable Reports

In-Depth Fund Reporting

Gain full visibility into fund performance with in-depth reports, detailed ledgers for line-by-line financial tracking, and intuitive dashboards. Generate period-specific profit & loss statements, analyze cash flow trends, and export data for deeper analysis.

Growth and Performance Insights

Monitor fund growth with customized reports and investor participation insights. Leverage dynamic metrics to refine your investment strategy and drive sustainable growth.

Why Choose Mortgage Automator?

All-in-One Solution

Customizable Reports

Streamlined Workflow

Data Accuracy & Transparency

Ready to Get Started?

Schedule A Demo Today